It’s essential to secure the appropriate life insurance policy to safeguard you and your loved ones in case of a severe illness, life-altering injury, or death. Hence, it’s prudent to evaluate the top insurance providers in the Australian market and beyond to identify the most suitable policy that meets your requirements.

With Appsivy, you can effortlessly compare various options and make an informed decision. By completing a straightforward and free online quote, you can access a variety of proposals from leading insurers in Australia.

What are the top ten largest life insurance companies in Australia?

- TAL Life Limited: 27.7% market share

- AIA Australia Limited: 18.3%

- Zurich: 13.8%

- MLC Limited: 10.6%

- Resolution Group: 7.9%

- BT/Westpac Financial Group: 5.4%

- MetLife Insurance: 5.1%

- QInsure: 3.3%

- Hannover: 3.2%

- ClearView: 1.7%

What are some of the best life insurance companies in Australia in 2022?

TAL:

TAL, which originated in New Zealand in 1869, has developed into the biggest life insurance provider in Australia. Over the years, it has acquired several other life insurance enterprises, such as Lifebroker, Suncorp’s life insurance division, and most recently, Westpac’s BT Life Insurance.

AIA Australia:

AIA, a global insurance company, started its operations in Australia under the name AIA Australia in 1972, providing various services such as health insurance, investments, and retirement plans. Recently, in 2021, AIA Australia acquired CommInsure Life, the life insurance division of Commonwealth Bank of Australia.

Zurich:

Zurich, a Swiss-based multinational insurance company, operates in over 215 countries and territories, offering a range of services such as life and business insurance and investment solutions. In Australia, it offers these services through its local business, while also owning OnePath, which is recognized as one of the leading life insurance providers in Australia.

MLC Life Insurance:

MLC Life Insurance is a life insurance company based in Australia, established in 1886, and currently owned by the Nippon Life Insurance Group. Its primary focus is on providing life insurance services. Additionally, the MLC brand offers various other products such as superannuation, investment solutions, and retirement plans.

MetLife:

MetLife, a global insurance company based in New York, has a presence in Australia through its local subsidiary, MetLife Australia. The company provides a range of insurance services in Australia, including life and business insurance, loan protection, and credit card insurance.

ClearView

ClearView is an Australian company that specializes in offering life insurance and wealth management solutions such as superannuation, pension, and various other investments. The company was initially known as NRMA Life, but it has since rebranded and no longer provides life cover under its former name.

Best Insurance Apps for iOS and Android:

- Oscar Health

- myCigna

- Religare Health

- MyAmFam

- Blue Shield of California

Oscar Health:

Founded in 2012 by Mario Schlosser and Josh Kushner, Oscar Health is a health insurance company based in the United States. It was among the pioneers in recognizing and implementing mobile technology solutions in the health insurance industry. The company offers an app that enables users to manage their policies and connect with doctors. With over 250,000 users, Oscar has partnered with more than 3,500 doctors. The company also provides each member with a dedicated team of care guides and nurses, who are always available to assist with any concerns or queries.

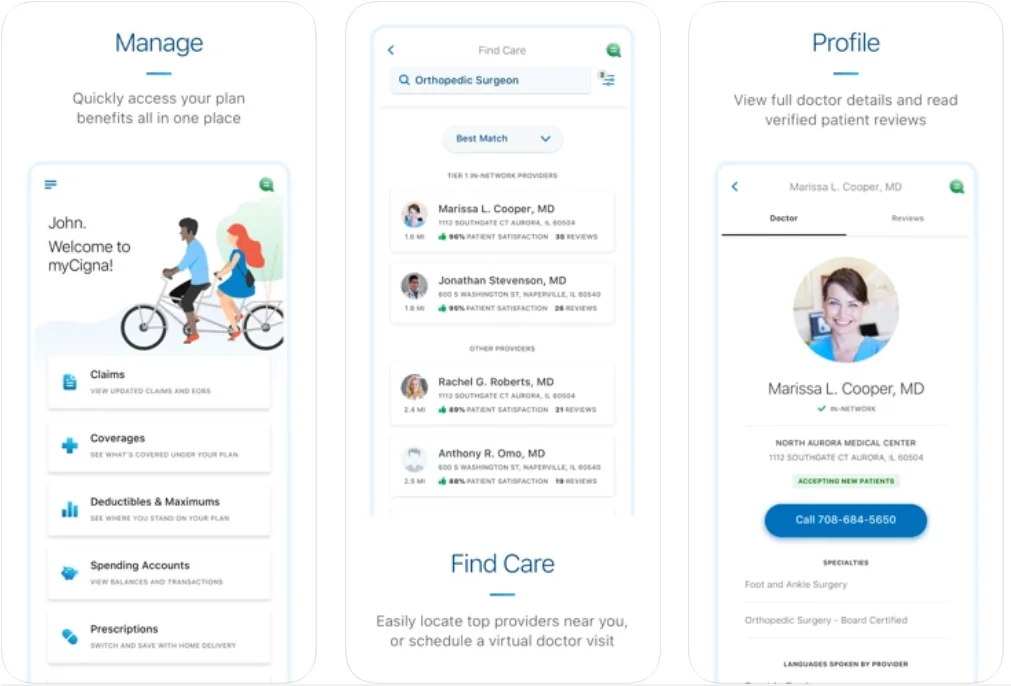

myCigna:

Cigna is a multinational health insurance company that offers its customers the myCigna mobile application, providing quick access to their health information while on the go. The app allows users to personalize and organize their data, with different features available depending on the type of plan, such as medical, dental, pharmacy, vision, behavioral, disability, and accident. The myCigna app is currently ranked #76 in the Health & Fitness category on the App Store.

Religare Health:

Established in July 2012, Religare Health Insurance Company Limited is an Indian health insurance provider. The company offers the Religare Health app, designed to assist users in managing their health insurance policies. Through the app, individuals can book appointments for health check-ups at any location, access and download their health reports, and utilize cashless outpatient services by scanning a QR code. The Religare Health app currently holds the #45 ranking in the Health & Fitness category on the App Store.

MyAmFam:

Headquartered in Madison, Wisconsin, American Family is an insurance company that provides health, life, vehicle, homeowners, business, and farm/ranch coverage. The MyAmFam app is designed to make it easy for customers to manage their American Family insurance policies. The app offers numerous features, including scheduled payments, claims and incident support, and the ability to check payment status in real-time. Users can also request a policy change or communicate with billing staff. MyAmFam is considered one of the top insurance apps for iOS.

Reliance Self-i:

Reliance Self-i is a mobile application created for Reliance General Insurance, aimed at streamlining and expediting the insurance claims and policy renewal procedures. The app offers swift claims processing and real-time updates on claim statuses. Additionally, the Reliance Self-i app features an E-Doc Vault, enabling users to securely store their policy and related documents.

Benefits of insurance apps:

- Process automation. Mobile apps automate the process of getting insurance.

- Growth of the customer base. The number of insurance apps is growing, as is the number of people who use them. Developing a mobile application can attract new customers.

- Simple communication. Apps for insurance provide a constant connection with customers. If your operators are busy or not available, a chatbot can help.

- Fast insurance policy issuance. Your employees will have more time for more urgent tasks.

- Personalized offers. An application for insurance can collect data on each user so you can create personalized offers.

- Fast feedback. When a client reports a claim using an app, you have the opportunity to respond quickly.

That’s all.